# Macroeconomic Data: unemployment rate

unemp_rate <- rio::import("https://byuistats.github.io/timeseries/data/unemp_rate.csv")Time Series Homework: Chapter 1 Lesson 3

Eduardo Ramirez

Data

Questions

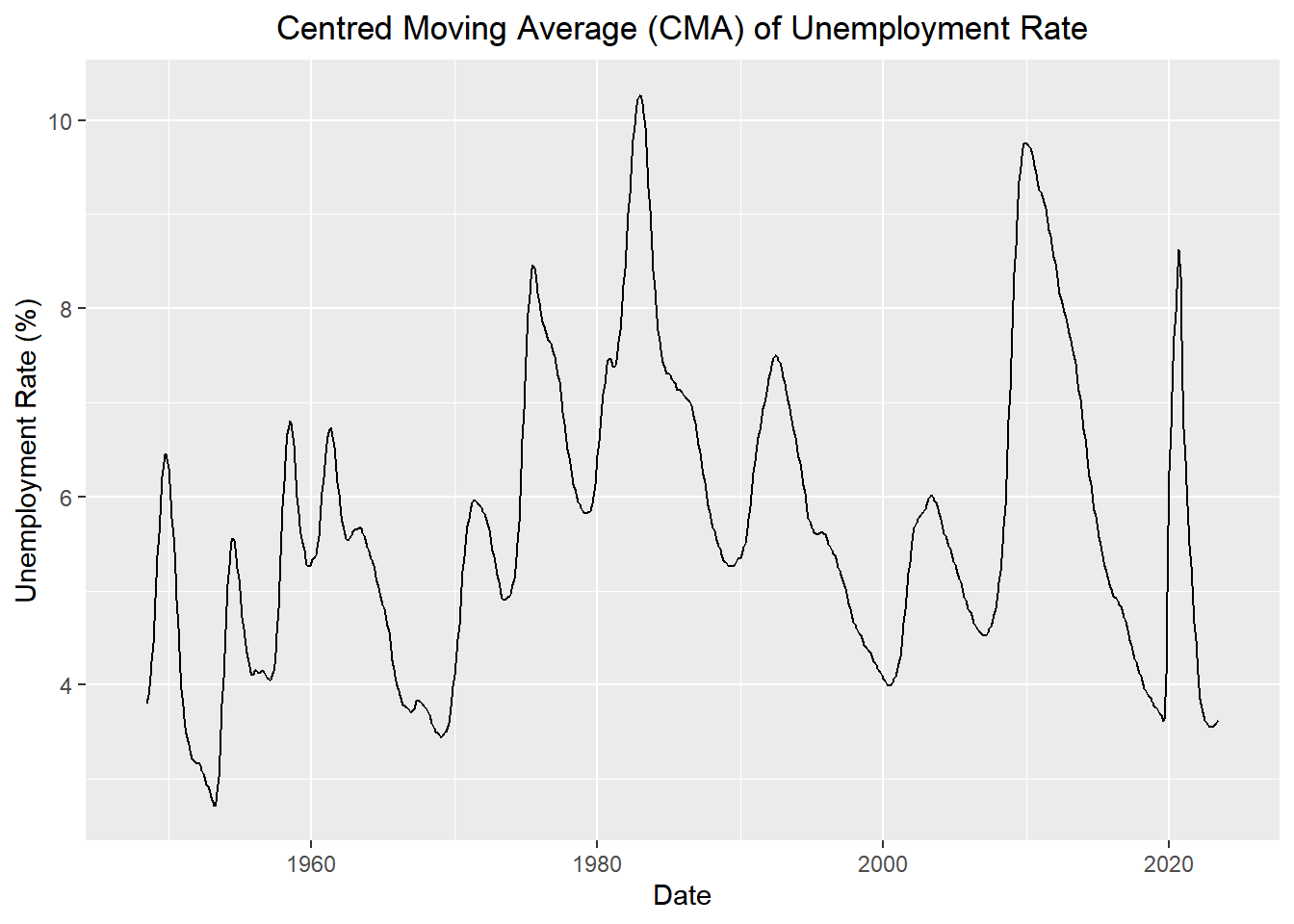

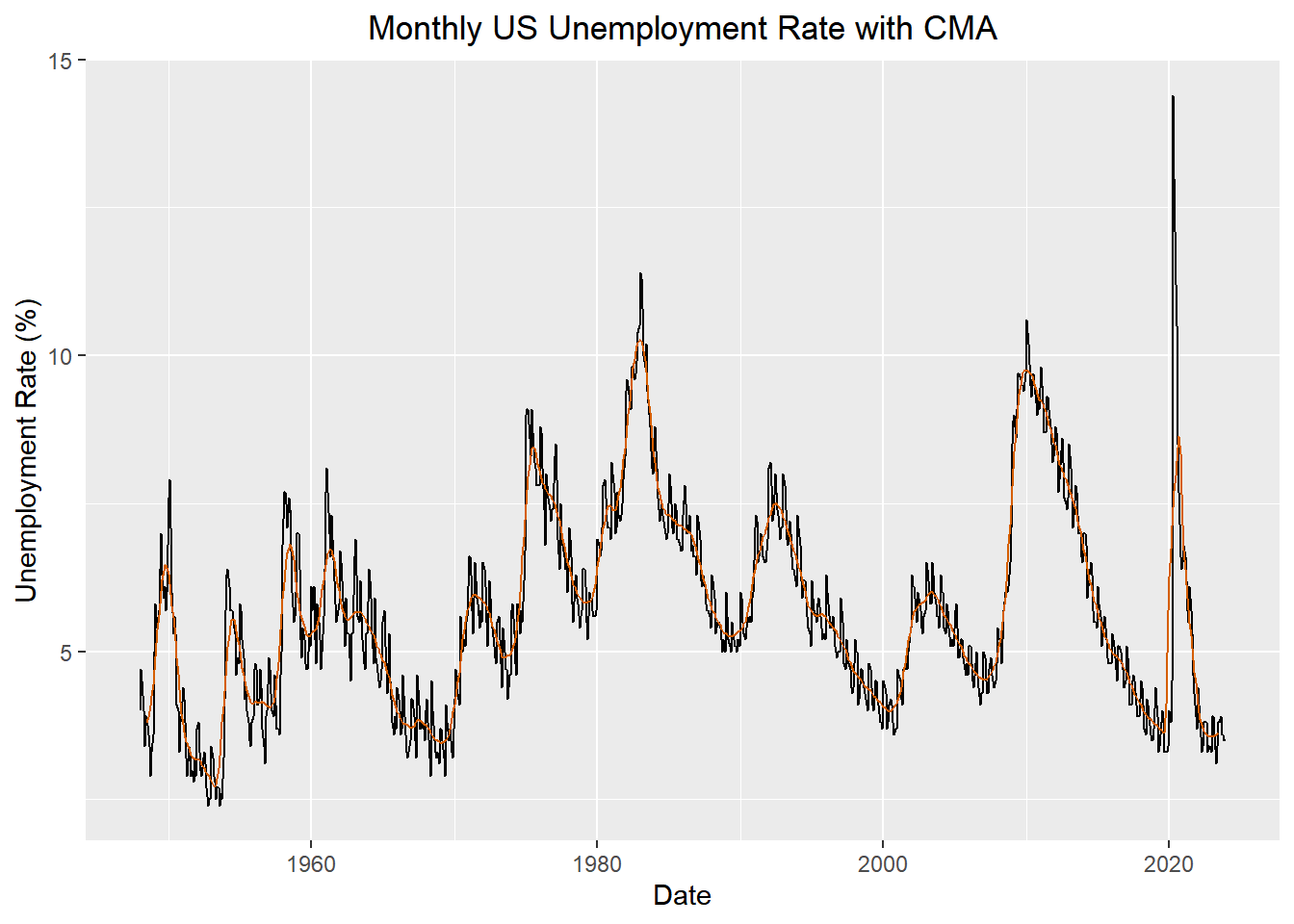

Question 1 - Estimating the Trend: Centered Moving Average (10 points)

Please plot the US Unemployment time series and superimpose the centered moving average series \(\hat{m}_{t}\) in the same graph. Don’t use an R command; rather, do it by coding \(\hat{m}_{t}\) like in Chapter 1: Lesson 3. Use the appropriate axis labels, units, and captions.

Question 2 - Seasonal Averages: Side-by-Side Box Plots by Month (10 points)

Please create a box plot to illustrate the monthly averages in the US Unemployment time series. Use the appropriate axis labels, units, and captions.

Question 3 - Seasonal Averages: Analysis (20 points)

a) Describe the seasonality of the US unemployment time series. Comment on the series’ periods of highest and lowest unemployment. Are there any notable outliers?

b) Please explain the patterns you found. Include information from your prior research on the series.

Rubric

| Criteria | Mastery (20) | Incomplete (0) |

| Question 1: Centered Moving Average | The student correctly employs the centering procedure to seasonally adjust the US unemployment series. | The student does not employ the centering procedure to seasonally adjust the US unemployment series. |

| Mastery (10) | Incomplete (0) | |

| Question 2: Box Plot | Creates a clear and well-constructed box plot that effectively illustrates seasonality in the US Unemployment time series. Labels both the x and y-axes, including appropriate units. Ensures clarity and accuracy in axis labeling, contributing to the overall understanding of the box plot. | There are mistakes in the plot. Fails to include any axis labels or units, resulting in an incomplete representation that lacks essential context. |

| Mastery (10) | Incomplete (0) | |

| Question 5a: Description | Provides an accurate description of the seasonality in the US Unemployment time series, capturing key patterns and trends effectively. Shows a good understanding of the recurring cycles. | Attempts to identify peaks and troughs but with significant inaccuracies or lack of clarity in the commentary. Shows a limited understanding of the variations. Fails to identify or comment on notable outliers, providing no insight into unusual data points in the US Unemployment time series. |

| Mastery (10) | Incomplete (0) | |

| Question 5b: Patterns | Shows understanding of the data to infer meaning in the seasonal averages. It’s clear the student did background research on the unemployment time series | Shows a lack of effort. It’s not clear the student understands the meaning of the data. |

| Total Points | 50 |